Setting Up Phone MT5 Trading Notifications For Pending Orders

18 June 2019The ability to set up phone notifications for trading activity on your MT5 platform has many advantages including of course the opportunity to “Check-in” on the market whist on the move.

It could be argued that this ability goes beyond simple convenience and in the case of “pending orders” could be viewed as an important part of risk management of trades that are opened through this method.

Pending orders revisited

Pending Orders are advanced entry orders that allow you to place an order onto the system that will be filled at a specific price level.

The key potential advantage is that you don’t have to be watching the market continuously for an order to be filled, and it can be filled at any time if the order is still active on the system.

An example could be placing a “Buy Stop” order above an identified resistance level, so if the relevant currency pair or CFD moves to this price point then the order will be filled at your chosen price (You can still place a stop loss and profit target associated with the pending order).

Although it a potentially attractive function of your Metatrader platform, one of the potential disadvantages is that without notifications set up you may not be aware that a trade has been entered until you are in a position to look at your trading platform on your PC for example.

Without this awareness of an “open” trade, the implications are:

- You will not be able to adjust a “trail stop” to lock in potential profit if the trade does go in your direction

- In the event of imminent economic data, you will not know to adjust such open positions to manage risks associated with this.

Setting up phone notifications on your phone, is not only relatively simple but mitigates these potential disadvantages.

Setting up notifications

We will walk you through the set-up process on MT5 but is similar if you are using MT4.

- Download the MT5 app on your mobile phone

- Allow to send “notifications”. Check in phone settings that it is set up.

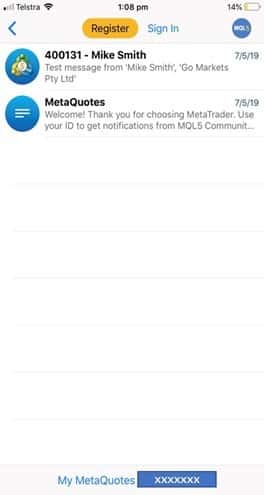

- Open the app and go to messages in settings and find your Metaquote ID at the bottom of the screen. Make a note of this (See diagram below).

- Open the MT5 platform on your PC

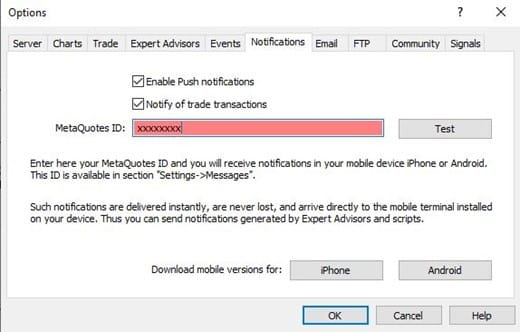

- In the tools menu, click on options and then the notifications tab.

- Enter your MetaquoteID in the pop-up box as shown below. Click on test

- You should receive a notification on phone that set up is complete and subsequently with any orders you place and that are filled.

Of course, feel free to contact the Encrypt Investment team if you need additional support in setting this up at any time.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Share CFDs: Know Your Costs

Many traders have the prudent approach that treats trading as you would a business. A critical component of this is to have a thorough knowledge of your expenditure in relation to your trading activity. With Share CFDs these are potentially fourfold, namely: Your cost of trading (e.g. brokerage) Your cost of holding a position The...

Previous Article

Hong- Kong Protests Add to Market Angst

It is reported that nearly two million people joined the mass protest against the controversial extradition bill on Sunday despite the government a...