The Dow Jones Industrial Average

27 December 2018

Source: Bloomberg Terminal

For the traders returning from the Christmas break, the sudden surge in the Dow Jones Industrial Average is probably the main event of significance to monitor. Major US equity benchmarks experienced the biggest daily gain in a decade. Until recently, those benchmarks were flirting with the bear market levels.

What has changed? “A tremendous opportunity to buy” and “I have great confidence in our companies.” were the comments from President Trump on the stock markets.

The President may have encouraged the “buy-and-dip” strategy so when Amazon reported record-breaking sales, bulls came in with force, and Wall Street soared.

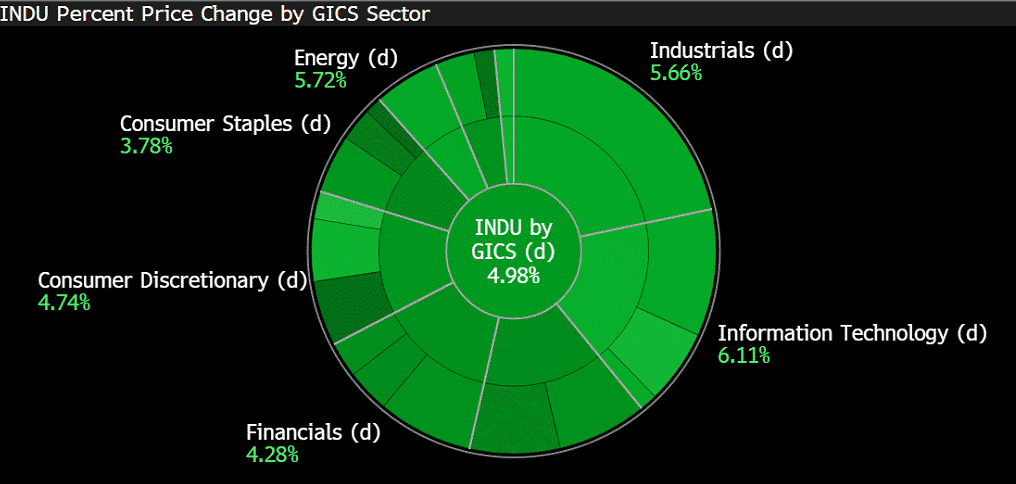

- The Dow surged by more than 1000 points on Wednesday, preventing the benchmark from falling into a bear market territory. The technology and energy sector were among the best performing-sectors.

Source: Bloomberg Terminal

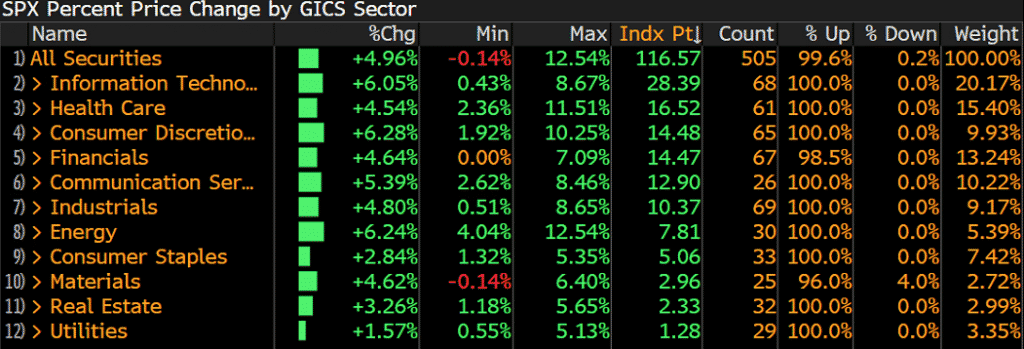

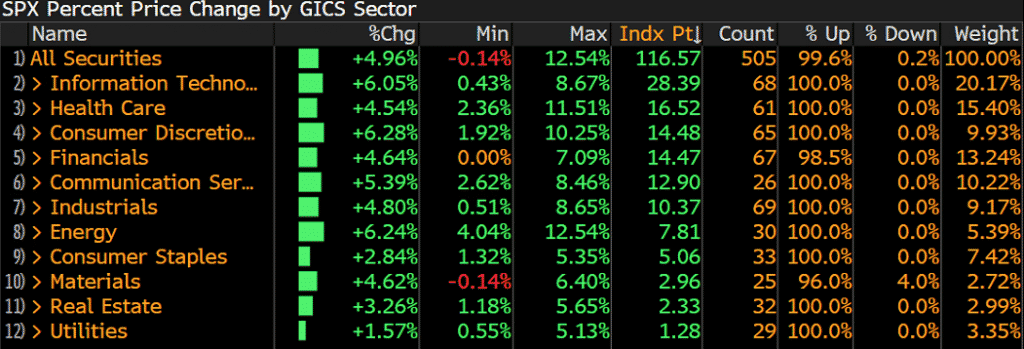

- The S&P 500 also rose by 5%, and 11 sectors within the benchmark were trading in positive territory. The technology, consumer discretionary and energy sectors were leading the gains while the material sector was on the back foot dragged by metals and mining stocks.

US500

Source: Bloomberg Terminal

- Nasdaq Composite also added 5.84% after suffering the worst Christmas-eve session. The wave of selling was halted on Wednesday.

Consequently, Asian stocks and the Australian equity benchmark are finding support from a historic night on Wall Street.

World Equity Indices

Amid the recent ‘Global Stock Rout’ the S&P TSX ended October down 6.51% following a somewhat hard month. However, during this risk-off flight to safety, the S&P TSX Index may have had its pain exacerbated by the heavy makeup of energy companies populating the Canadian index.

As discussed in previous articles – Oil – Can basic Economics be responsible for an 11% decline – Oil has seen some very aggressive sell-offs. Current market conditions have the commodity breaking below the $50 a barrel level amid supply concerns and growing global tensions. Keep in mind with Canada’s energy companies occupying an 18.6% weighting of the S&P TSX; undoubtedly this has been a weight around the Index’s neck dragging it lower.

Source: Bloomberg Terminal

Investors welcomed the relief rally. However, it may be too early to cheer up the recovery as the equity markets are still battling weak fundamentals, concerns over slow growth, trade tensions, political turmoil and higher borrowing costs.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Causes of Today’s Flash Crash

Today’s flash crash in the FX markets was surprising to many of us. The triggers behind the slump in the currency’s markets are vague, and everyone was left wondering about a reasonable explanation. First of all, we think it is important to note that we are in a low volume trading environment and any reaction/news can be exacerbated in such t...

Previous Article

Preview: The European Central Bank Rate Decision

With the Brexit negations dominating the news flow over the last few weeks, you may forget there are other events taking place. On Thursday, the Eur...