Dollar Index Treading on Familiar Ground

19 July 2018If you’re familiar with the US dollar Index, you might have noticed it has moved in a repetitive pattern for the past few years.

You need to treat every six months as a cycle, at the end of this cycle (June, December), the Fed will generally raise interest rates.

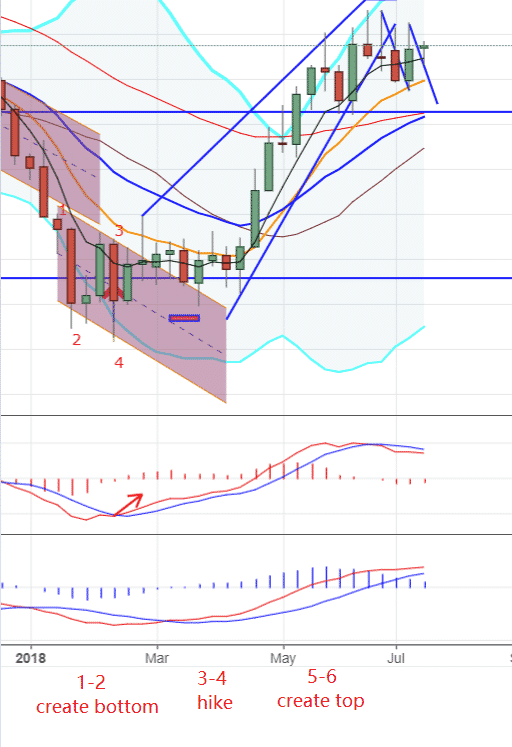

Here’s a look at how this pattern may look:

The Cycle

- Jan-Feb and July-Aug is the adjustment period, and since there is still a half year to go before the end of the cycle, it is unlikely to hold this high position all the time, so investors tend to take the profit and close positions causing the DXY to drop.

- The media suggesting that the dollar would fall to 85, I remember this vividly because at the time I spent three or four articles on debating with those who challenged my belief that the USD will go up, not down.

- In May and November, the price will often soar brutally, not even giving the herd a chance to catch up.

- June Dec, Fed announces the rate hike, causing the momentum to fizzle and all those previous excuses to maintain the price turn to dust. This final process completes the end of the cycle.

Eight weeks and falling?

For the past eight weeks, the USD has held below 95 levels. Similarly, the US 10-year bond returns cannot break the 3% ceiling. it is it likely that they will fall?

At present, there are two reasons why this may occur:

- There is only one country in the world to raise interest rates which is the USA. All other major countries within the EU, China, and Japan have no plans to raise interest rates. Although this strategy has the potential to harm the US’s opponents in some ways (for example, the Chinese stock market recently dropped dramatically), it doesn’t make themselves better off.

If the US 10-Year yield does breach upwards of 3%, it may harm all US companies and its domestic economy. Therefore, keeping the return around 3%, but not breaking it, seems a better option.

- The recent decline in CNY seems like a deliberate attempt by China to employ counteractive measures against the US’s trade war. The devaluation of CNY has numerous benefits. For example, it can offset the domestic exceeded hot money, create inflation to dilute debts, make export goods cheaper, offset the tariffs brought by trade wars, and so on.

US vs. China

Ultimately, the manipulation of monetary policies has both positive and negative effects and deciding who may win a trade war between the US and China is too hard to call. We will wait and see.

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Lanson Chen

Encrypt Investment Analyst

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Safety First for Japanese Yen

Have you spotted something unusual happening with the Japanese Yen? With the likes of protectionism dominating global headlines, the Yen is weakening amid broader risk aversion which is out of character for the currency. A Confidence crisis among Asian markets You have to wonder if the currency is absorbing some of the inherent uncertainty brought ...

Previous Article

Opportunities in the Third Quarter – Equity and Currency Markets

By Deepta Bolaky STOCK MARKETS After a stellar year for the stock markets, investors were entertaining the idea that equities will outperform in 2018 ...