Boeing and Facebook Earnings

31 January 2019Boeing (BA)

The Aerospace giant beat estimates and reported a record $101.1bn revenue for the year 2018. It is the first time that the company reports more than $100bn as annual revenue. Below is a summary of the fourth quarter earnings.

- Record revenue of $28.3 billion and record operating profit of $4.2 billion driven by higher volume

- Record GAAP EPS of $5.93 and record core EPS (non-GAAP) of $5.48 on a strong performance

Despite some uncertainties around trade tensions that rattled Boeing’s stock in the past few months, the year-end results far-exceeded Wall Street’s expectations. We saw record numbers in commercial aeroplane deliveries, which indicates a strong demand for commercial air travel.

The quarterly results helped drive the equity markets:

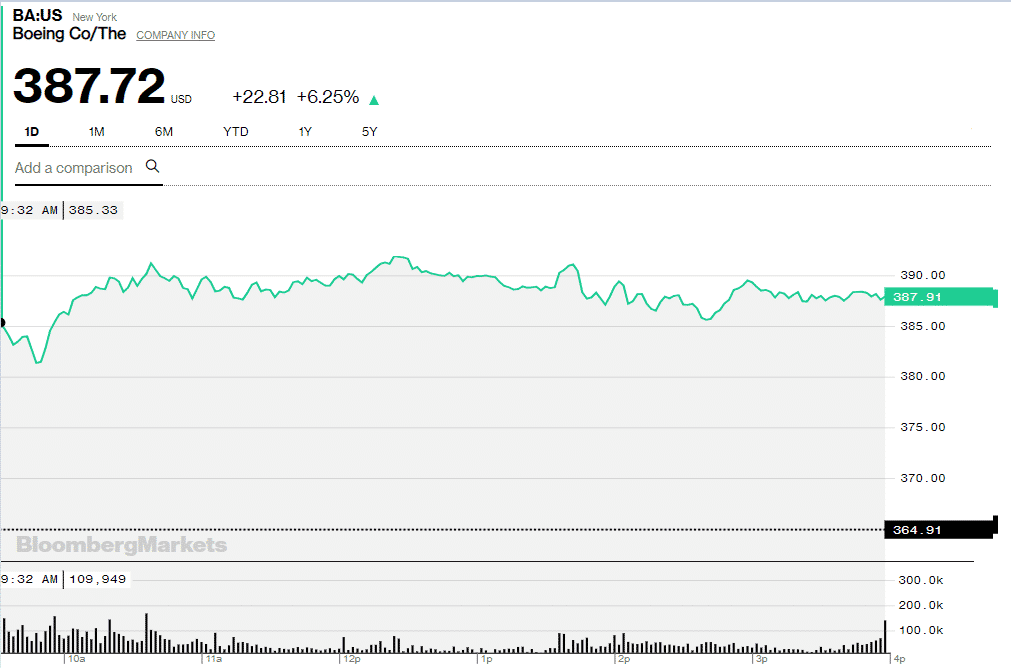

- Boeing’s share price jumped to $387.72, up by 6.25%:

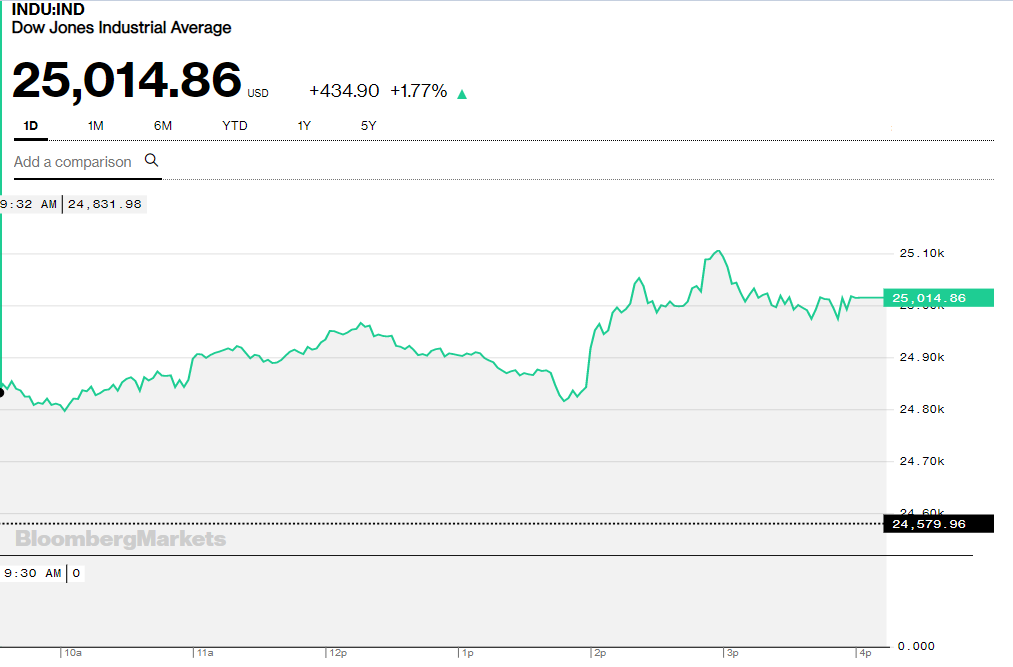

- The Dow Jones Average Industrials surged higher by 1.77% which is an addition of 434.90 points. The upbeat corporate earnings and a more dovish Fed helped the index close above 25,000, for the first time since December.

Boeing and China have a close relationship, and the CEO of the aerospace giant who has been involved in discussions with both governments sees progress on the trade front:

“China needs airplanes for growth to fuel their economy, while in the U.S., the aerospace industry is a “tremendous” jobs generator.”

The Company provides the following guidance on its outlook for 2019:

- Revenue guidance of between $109.5 and $111.5 billion reflects higher volume across all businesses

- GAAP EPS of between $21.90 and $22.10; core EPS (non-GAAP)* of between $19.90 and $20.10

- Operating cash flow expected to increase to between $17.0 and $17.5 billion

Despite the current trade tensions, it is good to see a company which is closely linked with China beating estimates and raise EPS and revenue forecasts.

Another surprise on the upside was Facebook. Despite privacy-related scandals, Facebook beats quarterly revenue and profit estimates. The growth was supported by Instagram business and the rise in advertising spending by companies.

Fourth Quarter and Full Year 2018 Operational and Other Financial Highlights:

- Daily active users (DAUs) – DAUs were 1.52 billion on average for December 2018, an increase of 9% year-over-year.

- Monthly active users (MAUs) – MAUs were 2.32 billion as of December 31, 2018, an increase of 9% year-over-year.

- Mobile advertising revenue – Mobile advertising revenue represented approximately 93% of advertising

- revenue for the fourth quarter of 2018, up from approximately 89% of advertising revenue in the fourth quarter of 2017.

- Capital expenditures – Capital expenditures were $4.37 billion and $13.92 billion for the fourth quarter and full year 2018, respectively.

- Cash and cash equivalents and marketable securities – Cash and cash equivalents and marketable securities were $41.11 billion at the end of the fourth quarter of 2018.

- Headcount – Headcount was 35,587 as of December 31, 2018, an increase of 42% year-over-year

The company’s privacy and data practices came under heavy scrutiny last year, yet this did not deter companies to ramp up advertising ads with Facebook. The release of the earnings report was overshadowed by the news that Facebook paid teens in order to monitor their phones via an unsettling research app which is only allowed to be used by Facebook or its employees.

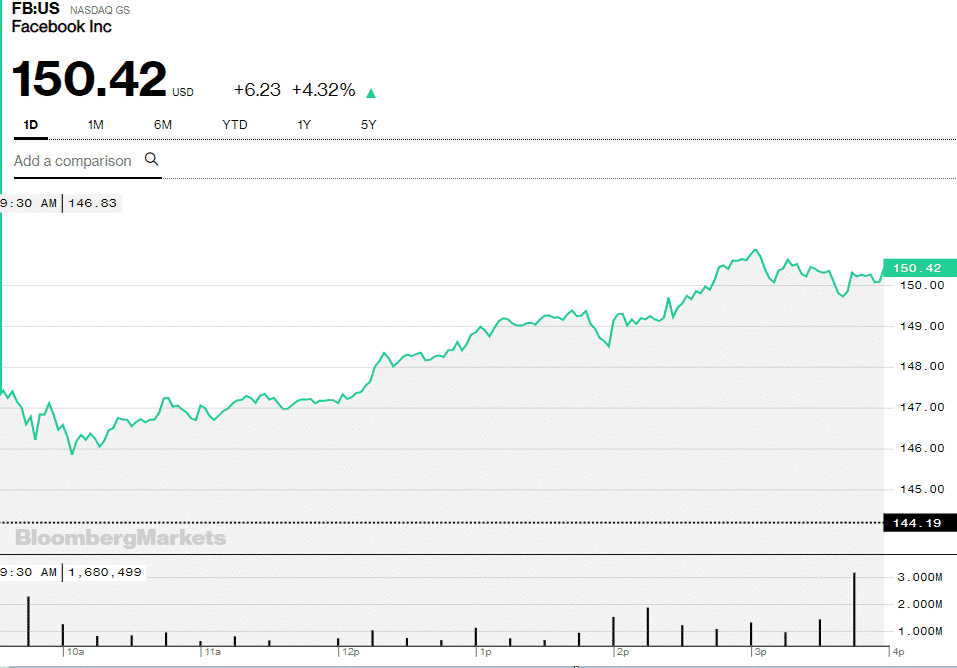

Facebook’s share price was rallying ahead of its earnings and gained 17.32% so far post-report in the extended hours.

Despite companies like Caterpillar, Tesla and Microsoft missing estimates or downgrading forecasts, Apple, Boeing and Facebook are among those that surprised on the upside. More dovishness from the Fed is also providing support to the equity markets.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Preview: Non-Farm Payroll Announcement

It’s a new month which means the latest Non-Farm Payroll figures will be released this Friday by the Bureau of Labor Statistics. The data is due to be released at 13:30 PM London time. Why is the announcement important? Non-farm payroll is one of the most closely watched indicators and is considered the most wide-ranging measure of job creati...

Previous Article

Apple’s First Quarter Results

Today, Apple reported its First Quarter Results which was largely in-line with expectations, except for the iPhone revenue, which that fell sligh...