Australian Earnings Results: Altium Kept the ASX200 in the Red

18 February 2020In the Australian share market, the focus remains on the earnings report. Most sectors were trading in negative territory with significant losses in the energy and information technology sectors. The technology sector was dragged by Altium Ltd.

Altium is the world’s leading software company. It has helped a wide range of companies succeed in designing next-generation electronic products and systems. The company has offices worldwide with around 600 employees and a rapidly growing network of channel partners. Their main operations centres are in:

- Sydney

- San Diego

- Munich

- Shanghai

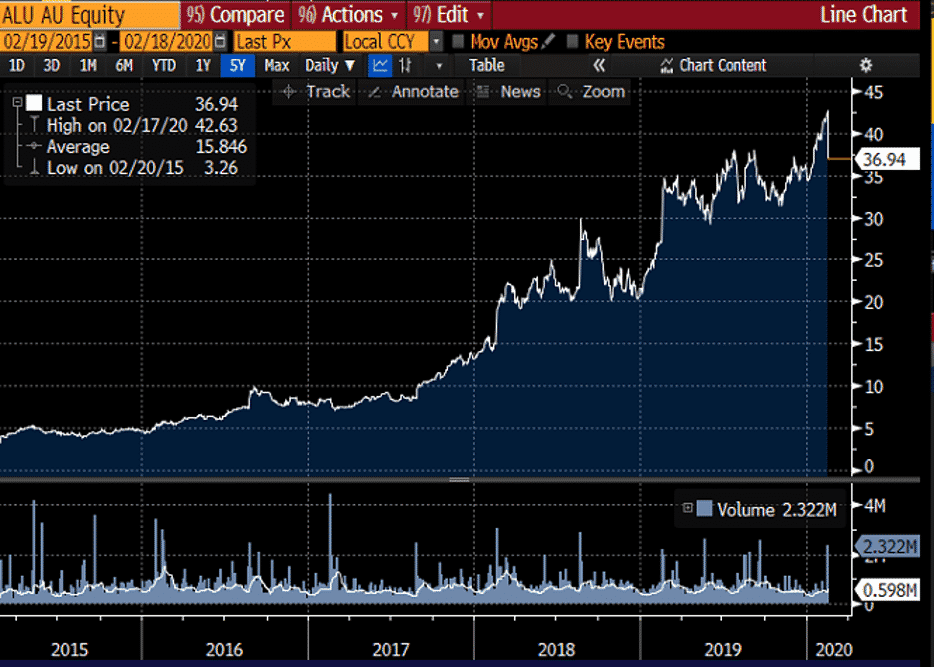

Altium at Record High

Ahead of the half-year results, the company’s share price was trading at an all-time high of $42.63 as investors were confident about the performance of the software company. However, its share price dropped on Tuesday after investors analysed the results and forecasts.

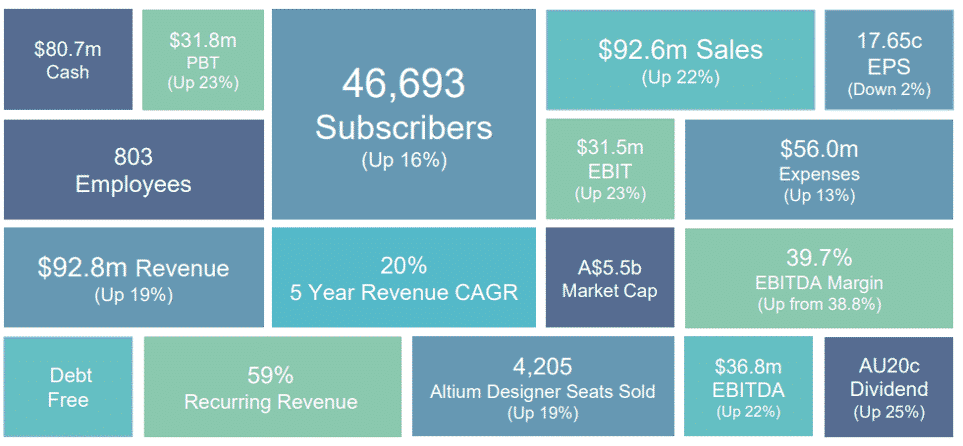

Source: Altium

The company delivered a strong half-year performance:

- Strong revenue growth of 19%

- Record EBITDA Margin of 39.7%

- A strong profit before tax growth of 23%

- Record growth of 16% increase in subscriber base to 46,693

- Record growth of 19% increase in Altium Designer seats with 4,205 new licenses sold

The Impact of the Coronavirus

Despite maintaining its full-year revenue between US$205m to US$215m and margin guidance, the company’s share price slumped by more than 15% on Tuesday morning. Given that one of the major operation centres is located in China and is an integral part of the business, the company warns of the emerging uncertainty of the impact of the virus.

As performance may be impacted, the company is expected to meet the lower end of the revenue and margin guidance. As of writing, its share price has pared some losses and is currently down by around 7% at $39.12.

About Encrypt Investment

Encrypt Investment was established in Australia in 2006 as a provider of online CFD trading services. For over a decade, we have positioned ourselves as a firmly trusted and leading global regulated CFD provider. Traders can access more than 250 tradeable CFD instruments including Forex, Shares, Indices and Commodities.

Follow us and keep up to date with the latest market news and analysis.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Australian Earnings Results – ASX200 Hits Record High

It was another busy day for the Australian share market with a series of corporate results; namely for Asaleo Care, Crown, Cleanaway, Domino's Pizza, Fletcher Building, Fortescue Metals, Lovisa, McPherson's, Mount Gibson, McMillan Shakespeare, Nearmap, Seven Group, Sonic Healthcare, St Barbara, Stockland, Vicinity Centres, Wesfarmers, and Wise...

Previous Article

Australian Earning Results: 17th February 2020

The Australian share market struggled to rise into positive territory on Monday. Sectors performance was mixed, with Information Technology, Energy...