WTI in Bear Mode

9 November 2018

Deteriorating demand and rising global output are the main factors that sent the WTI Crude into a bear market territory. There is a shift of sentiment in the oil markets. The US sanctions have been the primary influence behind the rally in oil prices, and now that fears have eased, fundamentals took over, and economic forces- demand and supply are driving the markets.

Supply Side

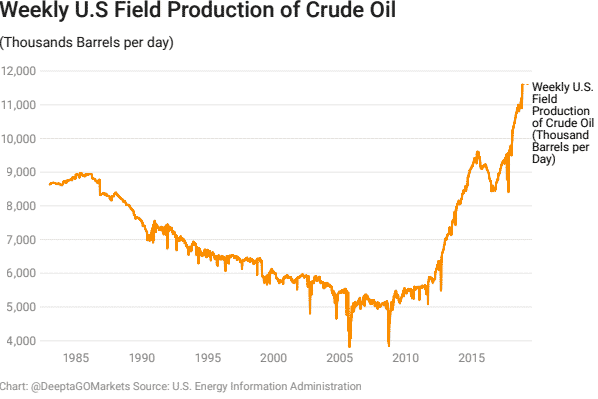

The US sanctions have created fears that oil supply will take a hit and will likely drop by 30% by next year. There was also resistance from OPEC members to increase the output ceiling and boost production. These downside factors have put upward pressure on oil prices. In the last couple of weeks, sentiment soured as US crude oil reaches a new all-time high at 11.63 million bpd and is predicted to break through 12 million barrels per day by mid-2019. The US sanctions on Iran will be therefore unlikely to have a significant impact on supply.

The US decision to offer Oil Waivers to different nations also came as a surprise mitigating the effect of the Iran sanctions on the global oil supply and accelerating the slide in oil prices. It appears that the waivers were put in place to avoid a shock in the market and higher prices.

Demand Side

The concerns over global economic growth are forcing traders to reduce their projections for oil demand. Trade tensions are flashing warnings that could dent the world’s oil demand growth. A slowdown in global economic growth, consumer spending, investment flows and a rising US dollar are leading to mounting uncertainties around the demand for oil. The demand shock is boiling over slowly, and the effect will likely be felt over time.

It is too soon to know how the OPEC will react to the supply glut. Meanwhile, we will have to wait for the OPEC and its allies to discuss scenarios of cutting production again next year.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Encrypt Investment Expands eFX Network with oneZero Collaboration

MELBOURNE, AUSTRALIA – 13 November 2018. Veteran derivatives provider Encrypt Investment Pty Ltd has integrated with technology provider, oneZero Financial Systems in a bid to expand their institutional offering in LD4. Head of Trading, Tom Williams said: “The popularity of our API offering has naturally led us to expand our distribution channels and ...

Previous Article

US Mid-Election & The Fed sticks to the Game Plan

The propaganda around the US mid-election dominated the markets this week. With the Democrats now in control of the House of Representatives, the...