War of Words US and North Korea Tensions

14 August 2017Markets are rattled by US- North Korea tensions as Trump vows to respond to North Korea nuclear threats with “fire and furry”. The senior administration officials and Secretary of State Rex Tillerson tried to find different ways to explain the President’s comments and play down the tough talk.

Trump reinforced his threats stating “they should be very nervous, because things will happen to them like they never thought possible”. The standoff has unsettled the financial markets worldwide.

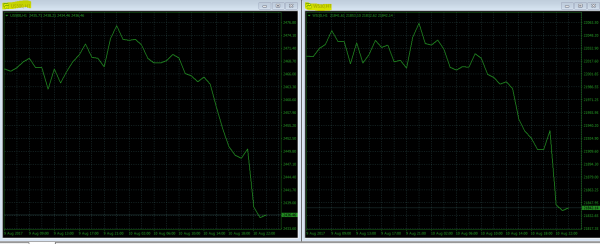

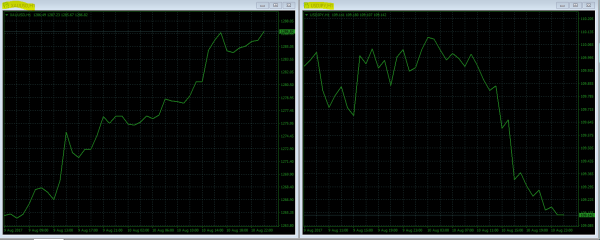

The DOW dropped by 200 pips and S&P 500 fell to sessions lows. The CBOE Volatility Index, the best gauge of fear in the market spiked by 45%.

The demand for safe havens has increased with the rising tensions. Investors have switched to gold, yen, swiss franc and government bonds. USDJPY dropped to record low and Gold rose to its highest level in almost 2 months.

.

The risk sentiment gets hit by the escalating geopolitical tensions as Japan and South Korea also warned of a strong response if North Korea launches missiles toward Guam. Trump intensifies its warnings to North Korea as he believes that even if Russia and China are backing the UN sanctions, it would not be enough or effective as negotiations have been going on for years. The Nikkei index fell since the “war of words” started.

Chinese media warn that the US is engaging in dangerous confrontations. “The US is more powerful than North Korea, but in a real showdown I don’t think they would beat North Korea. There is a Chinese saying: ‘A man with nothing to lose, doesn’t fear a man with something to lose” Hu Xijin, outspoken editor of the Global Times said.

The coming days will be crucial. Investors will be looking for a “diplomatic outcome” rather than militaristic conflict.

By: Deepta Bolaky

Encrypt Investment

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

German Election

The German election is one of the key elections for the Eurozone following the French and UK elections. Angela Merkel is in the final month of campaigning for a fourth term in power. With an anti-immigration party continuing to capture segments of the electorate, Merkel might be faced with a coalition with one or more opposition parties. Pol...

Previous Article

South Africa Jacob Zuma Update

South Africa Update 8th August 2017, the day president of South Africa, Jacob Zuma survived a no-confidence vote in parliament, which made sure that h...