Latest US Jobs Report

5 October 2018The Buraeu of Labor Statistics have released the latest jobs report for September. Let’s take a look at the latest numbers.

The total non-farm payroll employment increased by 134,000, the U.S. Bureau of Labor Statistics reported today versus the forecast of 185,000. Biggest job gains were in professional and business services, in health care, and in transportation and warehousing.

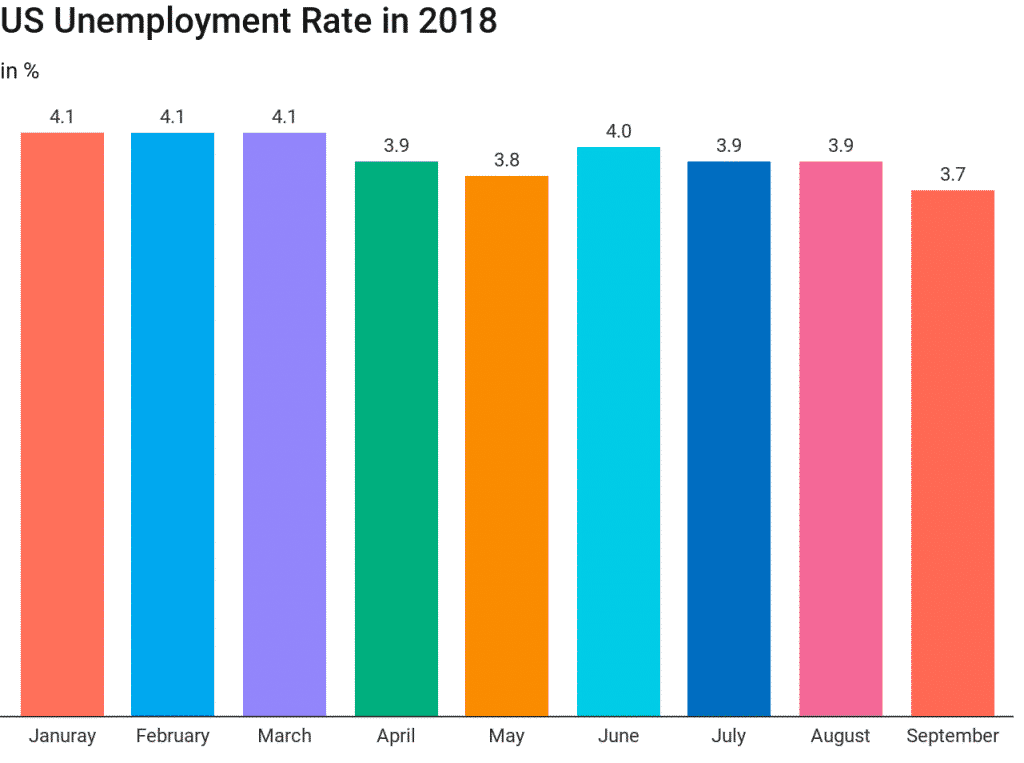

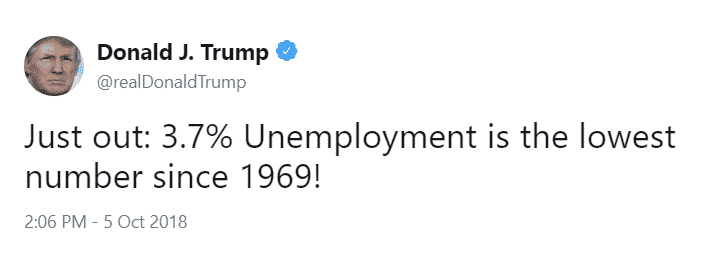

The unemployment rate declined by 0.2% to 3.7% in September better than the forecast of 3.8%. Worth pointing out that the latest unemployment rate is the lowest level for 49 years. The number of unemployed people decreased by 270,000 to 6 million.

Average hourly earnings dropped from 2.9% to 2.8% as anticipated.

The reaction

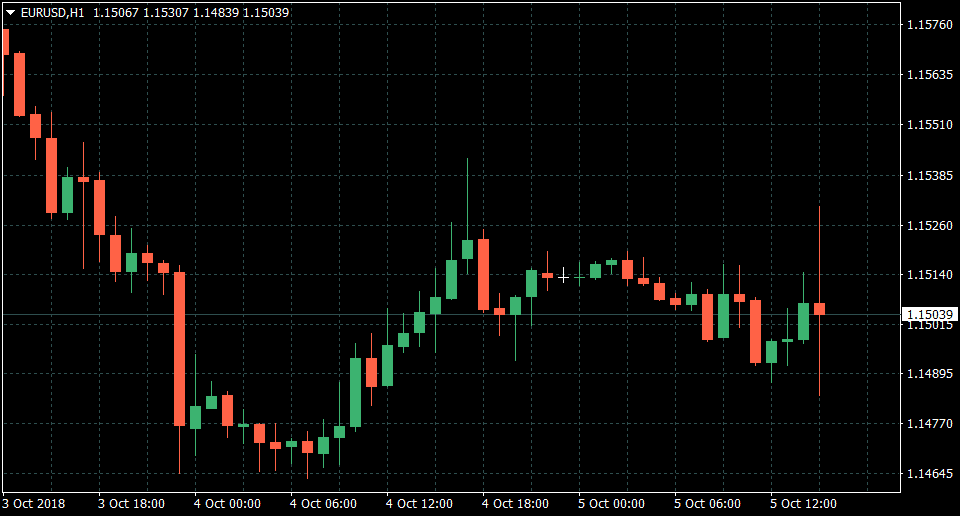

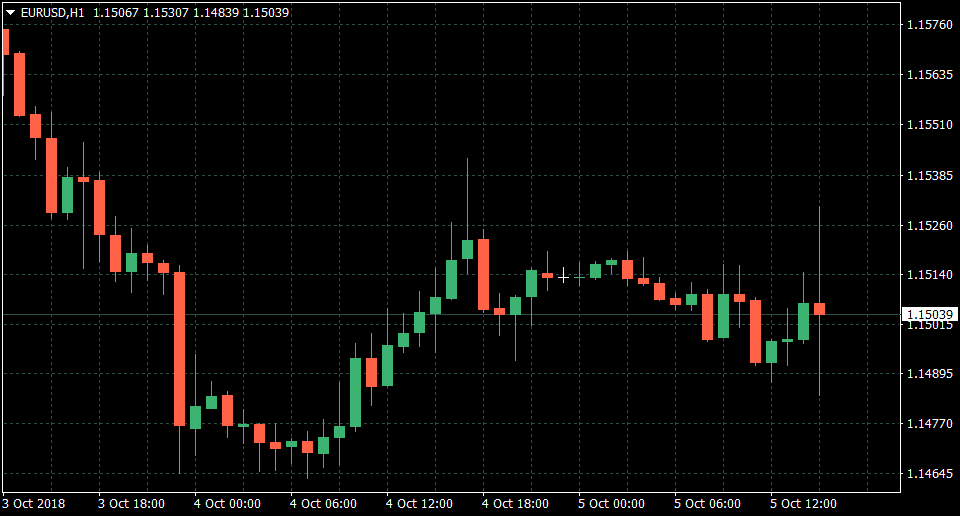

Initially we saw some weakness in the US dollar as the latest figures were released, however, since then the Dollar has recovered some losses.

Average hourly earnings dropped from 2.9% to 2.8% as anticipated.

USD/JPY Hourly Chart

GBP/USD Hourly Chart

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Bloomberg, Encrypt Investment MT4

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Weekly USD Round-up: 08/10/18

Last week's ATR: 95-96.1 From the daily chart below, we can see that the US Dollar Index is currently testing its right shoulder, and I have marked the left and right shoulders by two red rectangles. It will take weeks for the price to tumble around the rectangle area, and there might be a lot of fake movements occur, thus it is still too soon to...

Previous Article

What Lies Ahead For Japan

In the midst of Wednesday afternoon's global bond sell-off, we saw government bond yields rise across the board and in one particular 10-year bond we ...