Italy’s “First Budget” By the Populist Government

23 August 2018The newly-elected populist government in Italy will deliver its very first budget which will be pivotal to the Eurozone area. Italy has the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are questioning whether Italy will be able to repay its debt.

Debt to GDP ratio (%)

Why is the Italian budget a key event for the markets?

The Italian Budget is crucial because it poses a potential threat to the stability of the bloc and the Euro. The Budget will dictate whether the new government will follow the European Union’s rules but most importantly, it will help to gauge whether the coalition parties are getting along well.

The Italian economy might not be able to support a massive spending bill. Investors will be most concerned about the fiscal roadmap of the country.

The Five Star and the League have ambitious tax and spending plans which are the foundations of their respective party. They have vowed to spend more, and for the coalition to work, the spending plans of both parties will have to be considered. The critical question that arises is:

“Will the Budget blow the EU’s 3% deficit level?”

Being one of the weakest links of the Eurozone, markets participants are wary of the possibility of a debt crisis. The EU has a ceiling level of 3% concerning a budget deficit, and investors are increasingly alarmed at the prospect that Italy might breach this limit. The Budget will likely be focal in gauging its fiscal discipline. The budget proposals by the new Italian government has also placed Italy on the negative watch for Moody’s rating back in May. The evaluation has been postponed until further information on the budget is revealed.

The markets could see fresh turmoil if credit rating agencies flashed an adverse outlook on what the government is doing.

According to the Minister of Finance, the Budget deal will be published in September, and we expect it to bring some volatility in the EUR pairs. Currently, the EURUSD is relieved from its selling pressure on the back on the US dollar weakness. It is very probable that any noises about the Budget will cap any gains if there are rising fears that it will breach the EU Budget rules.

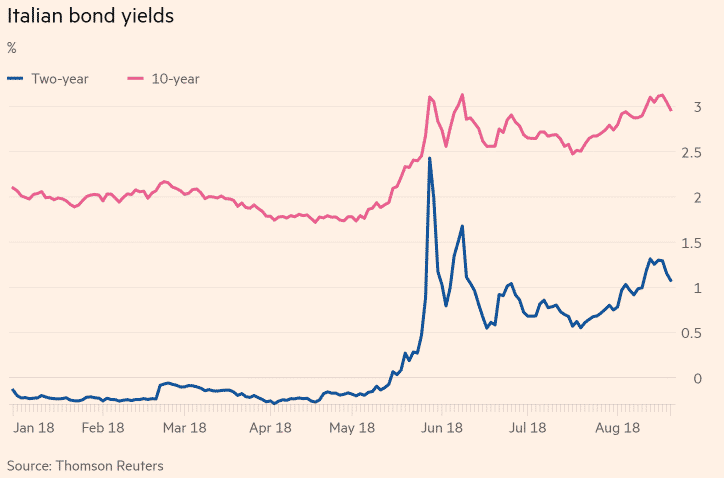

Alongside any developments in the Italian Budget, EUR bulls might want to keep an eye on the Italian bond yields for fresh impetus!!

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

World Trade – Winners and Losers

We hear a lot these days about countries having ''trade wars'' between each other, most recently the United States vs China ''trade war'' which was initiated by President Trump and is still ongoing. The United States has a huge trade deficit with China, world’s second largest economy and it will be interesting to see who if anyone will come out o...

Previous Article

Jackson Hole Symposium: Why Is It Important?

All eyes will be on the Jackson Hole in Wyoming this week, where the annual Jackson Hole Economic Symposium will be held by the Federal Reserve Bank o...