G20 Summit 10th Anniversary

16 November 2018In the wake of the global financial crisis, the G20 summit has become a popular forum of global governance and cooperation. In the heat of the disaster, G20 members came together to sustain global financial stability. The G20 has been a useful pool of information and decision making that have steered the global financial markets since 2008.

G7 Summit

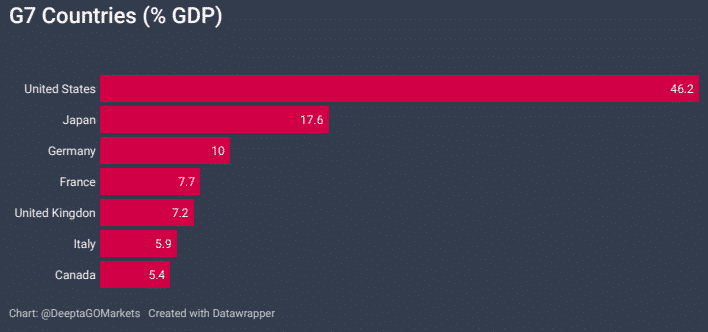

The Group of Seven consists of the most industrialised and advanced countries in the world representing 58% of global net worth and 30% of the world’s economy. The G7 Summit focuses on the broader array of economic and political challenges.

G20 Summit

The financial crisis in 2008 recognize the era where countries need to seek more cooperation among themselves to promote a sound global financial system. Therefore, the G20 is primarily dedicated to international economic cooperation and allows China, India and other emerging nations to take a more significant global role. It acknowledges the shift towards emerging economies. G20 accounts for 84% of global investment and 63% of the world’s population.

Argentina has set “Building Consensus for fair and sustainable development” as the slogan for the leaders’ summit this year concentrating on three key priorities “the future of work, infrastructure for development and food security.” However, protectionism measures have been the main talks ahead of the summit. In the meeting in Bali earlier this year, all the members agreed that heightened trade and geopolitical tensions are among the most critical downside risks in the short and medium term.

The G20 summit is, therefore, the “Golden Opportunity” for Trump and other leaders to engage in trade talks. Face- to face meetings might be better to ease trade frictions. As of writing, news that China has outlined a series of trade concessions are emerging. Hence, investors are optimistic that the G20 meeting might bring more positive news than anticipated couple of weeks before given that the US-China decided to restart trade negotiations.

The Summit has the potential to move the financial markets, and any headlines will likely go under intense scrutiny.

Mark Your Calendar – 30 November – 01 December!!

*Follow us on  Twitter for more updates regarding the upcoming G20 summit

Twitter for more updates regarding the upcoming G20 summit

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Encrypt Investment formally launches MetaTrader 5

MELBOURNE, AUSTRALIA – 25 September 2018. Encrypt Investment is pleased to launch MetaTrader 5 (MT5) to its suite of platforms. Traders can now download, and use Encrypt Investment MT5 along with Encrypt Investment MT4, as well as Encrypt Investment’ Webtrader, on any device or browser. Chief Executive Officer, Christopher Gore, noted that while he continues to see solid dem...

Previous Article

Encrypt Investment Expands eFX Network with oneZero Collaboration

MELBOURNE, AUSTRALIA – 13 November 2018. Veteran derivatives provider Encrypt Investment Pty Ltd has integrated with technology provider, oneZero Financial ...