EURGBP – Sterling Applying The Pressure

26 January 2021EURGBP – Hourly

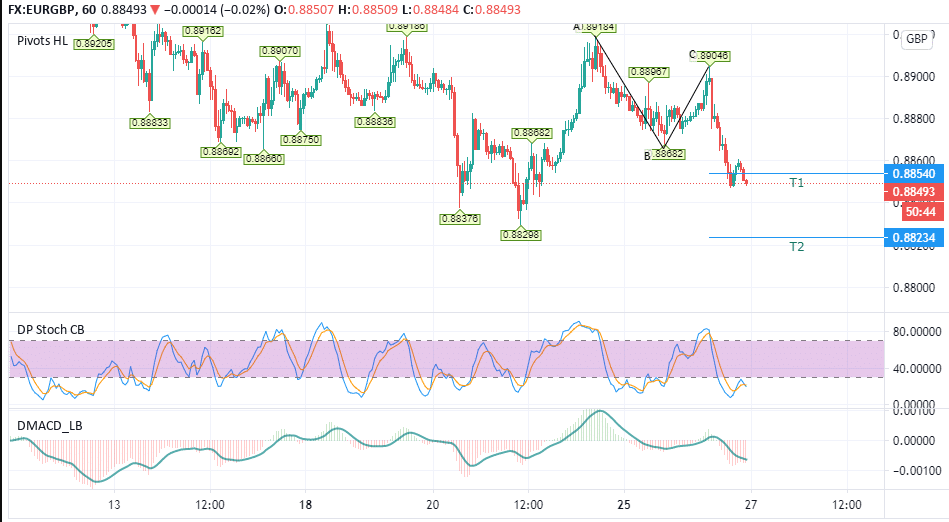

Since the 12th of January, we’ve seen much choppy price action in the EURGBP cross, with Pound Sterling applying the more significant selling pressure. This shorter-term bearish bias is what we’ll be looking at in today’s Chart of The Day using the hourly time frame.

Firstly, we can see the initial DiNapoli target of 0.8854 or (T1) has already been achieved early today during the London session. The second target of 0.8823 (T2) is still active. Note both potential targets were calculated using the price points labelled (A),(B), and (C), respectively.

Next, we can see a divergence between the fast stochastic indicator and the MACD shown. While the stochastic just provided a buy signal, the MACD remains considerably bearish. Based on this data and the general view that the Pound is gaining strength, I suspect we may see a slight bounce around the current levels of 0.8851, mainly as it’s acted as support recently before the pair falls to lower levels.

To the upside, the recent high around 0.89 looks to be the central area of resistance for the time being. Of course, anything is possible in these Covid-19 times, especially with negative talks brewing across Europe over vaccine distribution. Still, GBP appears to be riding the choppiness more favorably at this stage.

Sources: Encrypt Investment, Meta Trader 5, TradingView, Bloomberg

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Overnight on Wall Street: Thursday 28 January 2021

Equity markets US and European Equity markets suffered a considerable drop last night with the S&P 500 (US500) posting its worst session since October and European markets their worst session of the year. The FOMC policy statement overnight struck a less dovish tone than investors had hoped for, while the central bank kept benchmark interest ...

Previous Article

Week Ahead: US Earnings season, FOMC and weaker than expected Oil demand

Major US, European and Australian Indices made modest gains last week, despite a Friday sell off on Wall St. Traders will have no shortage of news t...