Sweden Election

7 September 2018

The Sweden election is set to take place this weekend. Every general election in Europe is revolved about this new dynamic – the rise of anti-EU parties.

Euroscepticism and anti-immigration policies are at the heart of the September 9th, General Election.

The impact of the outcome of the election on the markets will depend on the coalitions:

- Leftist Coalition (Red Coalition) consists of the Left Party, Green Party and Social Democrats. As a group, the leftist coalition advocates more jobs, better education, climate change, welfare services and gender equality. While the Green Party promotes EU integration, the Left party supports an EU- exit.

- The Alliance (Blue Coalition) is a coalition between the Moderate Party, Centre Party, Liberals Party and Christian Democrats. They support the reduction of taxes and unemployment, economic liberalism, environment and integration, and improving the school system.

- Sweden Democrats are the Euro-Sceptic Party and are first and foremost associated with the issue of immigration. They believe that the Immigration Policy has put enormous social and economic pressures on the country.

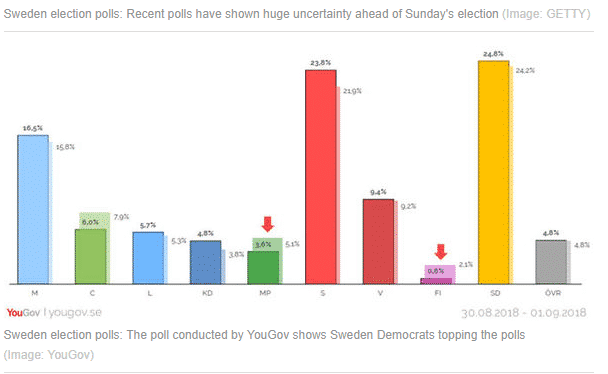

Opinion polls have shown that the Sweden Democrats are on the rise, and there is a considerable uncertainty ahead of Sunday’s election. The possibility of one party winning a majority is very slim, and the mainstream parties have vowed not to form a coalition with the Sweden Democrats.

The Effects of the Election on the Financial Markets

The markets are not expecting massive volatility in the stock markets, but the election results will likely be stimulating for the welfare and education stocks.

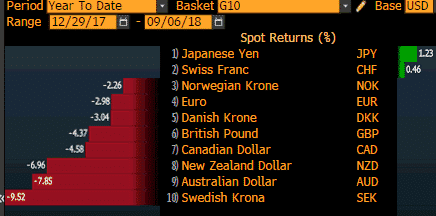

In the Forex markets, we are expecting the results of the election to drive the price action in the SEK pairs. The Swedish Krona is currently the worst performing currency among the G10 currencies against the US Dollar since the beginning of the year.

The Krona is also facing the same main issues that are fuelling its slide against the US dollar as other developed currencies:

- Trade: Sweden’s most valuable exports are cars, drugs and medicines, auto-parts, phones amongst others. Exports stand at more than 45% of its GDP which makes the local currency vulnerable to the current trade tensions.

- Interest Rate: The policy divergence between the Fed and the Riksbank is also putting pressure on the SEK. The economy is strong but inflationary pressures are still moderate which is preventing the Riksbank from hiking interest rate.

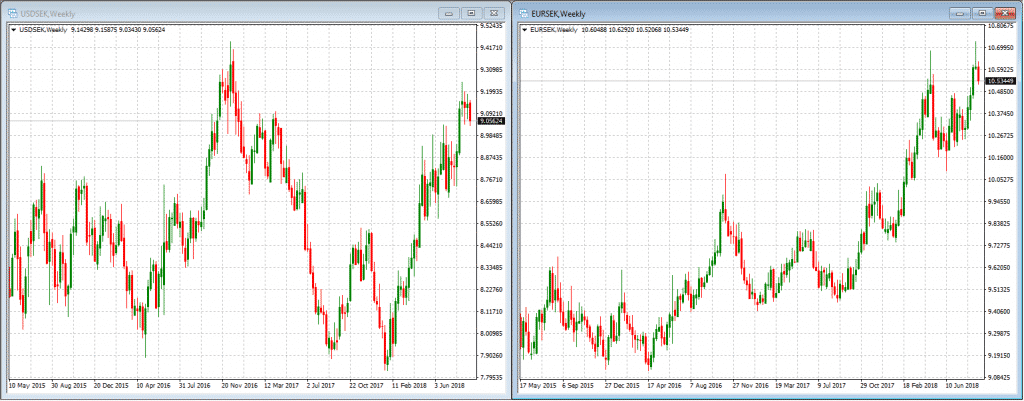

Adding another uncertainty to the mix is the upcoming election. The latest poll shows that the Sweden Democrats remained the largest party which is intensifying the uncertainty ahead of the votes on Sunday. The Swedish Krona has been under intense pressure in the months ahead of the election.

Last week, the pair rose to nearly 19-month and 9-year low against the US dollar and Euro respectively.

Source: Encrypt Investment MT4

At the time of writing, we are also expecting the Riksbank interest rate decision to come through. If the central bank maintains its existing forecast to hike later this year, we will see the Swedish Krona trading on the upside ahead of the election. However, whatever the markets reaction will be after the rate statement, traders will be exposed to the outcome of the Sunday’s election.

The results could either extend or reverse Thursday’s moves.

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Sweden – First Cashless Society?

When it comes to talking about countries becoming cashless, Sweden appears to be at the forefront of people's minds as the leading contender to achieve this economic transition. Historically, the Swedes have a habit of steering social trends before other countries catch on so no great surprise there. However, it is not only Sweden who received n...

Previous Article

The Art Of War & Trading: Part 3

军形篇 - The Chapter of Tactical Dispositions Original Text: 善战者,先为不可胜,以待敌之可胜。 Translation: Good commanders firs...