Preview: Non-Farm Payroll Announcement

6 June 2019

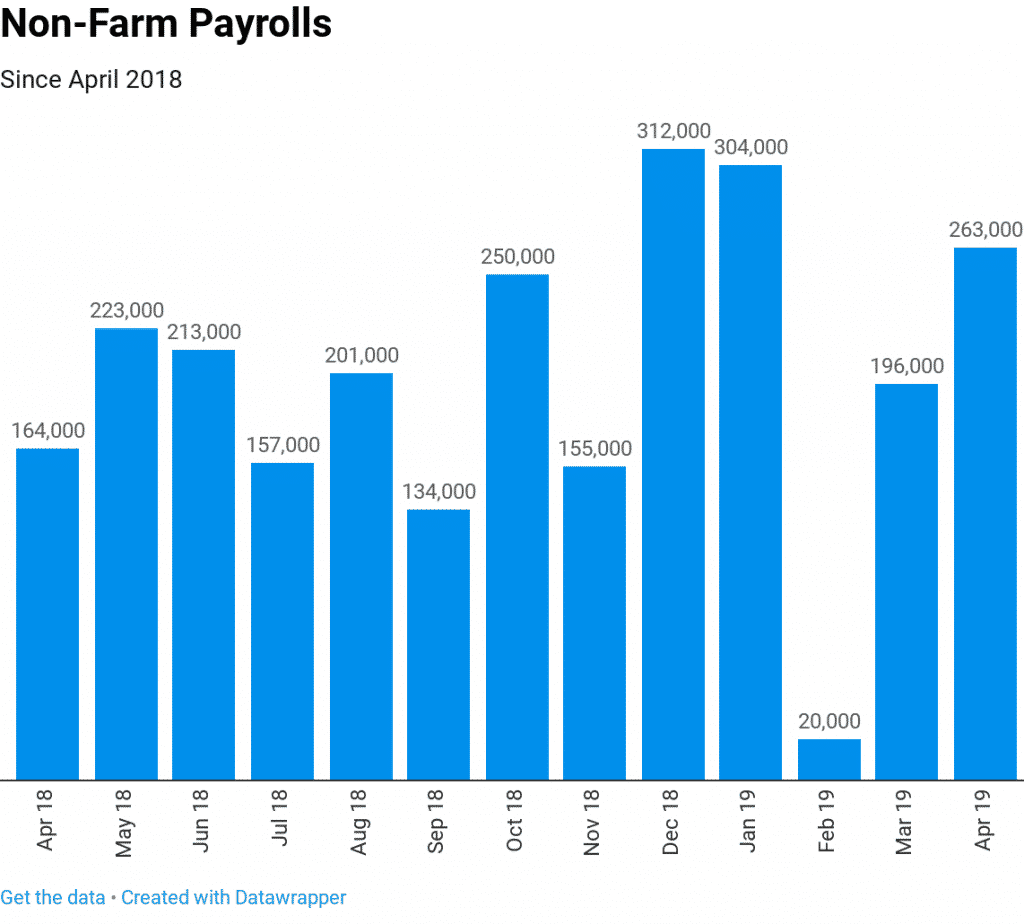

It’s a new month which means the latest Non-Farm Payroll figures will be released this week by the Bureau of Labor Statistics. The latest data will be released at 13:30 PM London time on Friday.

Why is the announcement important?

Non-farm payroll is one of the most closely watched indicators and is considered the most wide-ranging measure of job creation in the United States. An increase in the non-farm payrolls would suggest rising employment and potential inflation pressure which would mean a potential rate increase by the Federal Reserve. A decline would suggest a slowing economy which would mean a decline in the interest rates more likely. The measure accounts for around 80% of the workers who contribute to the Gross Domestic Product.

Expectations

Last month, the total non-farm payroll employment increased by 263,000 beating the economist’s forecast of 190,000. Most significant job gains were in professional and business services, construction, health, and social assistance.

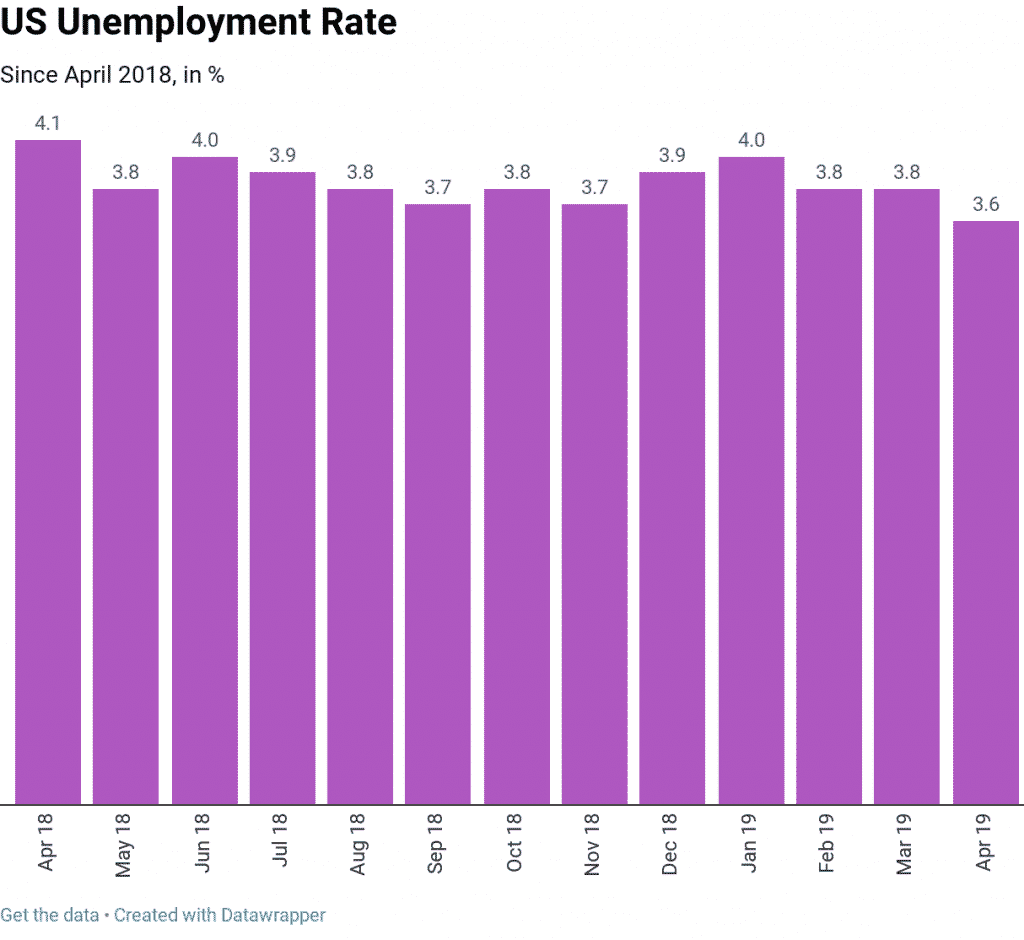

Economists are expecting an increase by 180,000 in the month of April. The unemployment rate is expected to remain unchanged at 3.6%. Average hourly earnings are also expected to remain unchanged at 3.2% after coming in below forecast last month.

All eyes on the announcement.

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Datawrapper, Investing, U.S. Bureau of Labor Statistics

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Share CFDs: Know the costs.

Many traders have the prudent approach that treats trading as you would a business. A critical component of this is to have a thorough knowledge of your expenditure related to your trading activity. With Share CFDs these are potentially fourfold namely: a. Your cost of trading (e.g. brokerage) b. Your cost of holding a position c. T...

Previous Article

Preview: The Bank of Canada Rate Decision

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wedn...