Preview: Non-Farm Payroll Announcement

2 May 2019

It’s a new month which means the latest Non-Farm Payroll figures will be released this week by the Bureau of Labor Statistics. The latest US jobs data will be released at 13:30 PM London time on Friday.

Why is the announcement important?

Non-farm payroll is one of the most closely watched indicators and is considered the most wide-ranging measure of job creation in the United States. An increase in the non-farm payrolls would suggest rising employment and potential inflation pressure which would mean a potential rate increase by the Federal Reserve. A decline would suggest a slowing economy which would mean a decline in the interest rates more likely. The measure accounts for around 80% of the workers who contribute to the Gross Domestic Product.

Expectations

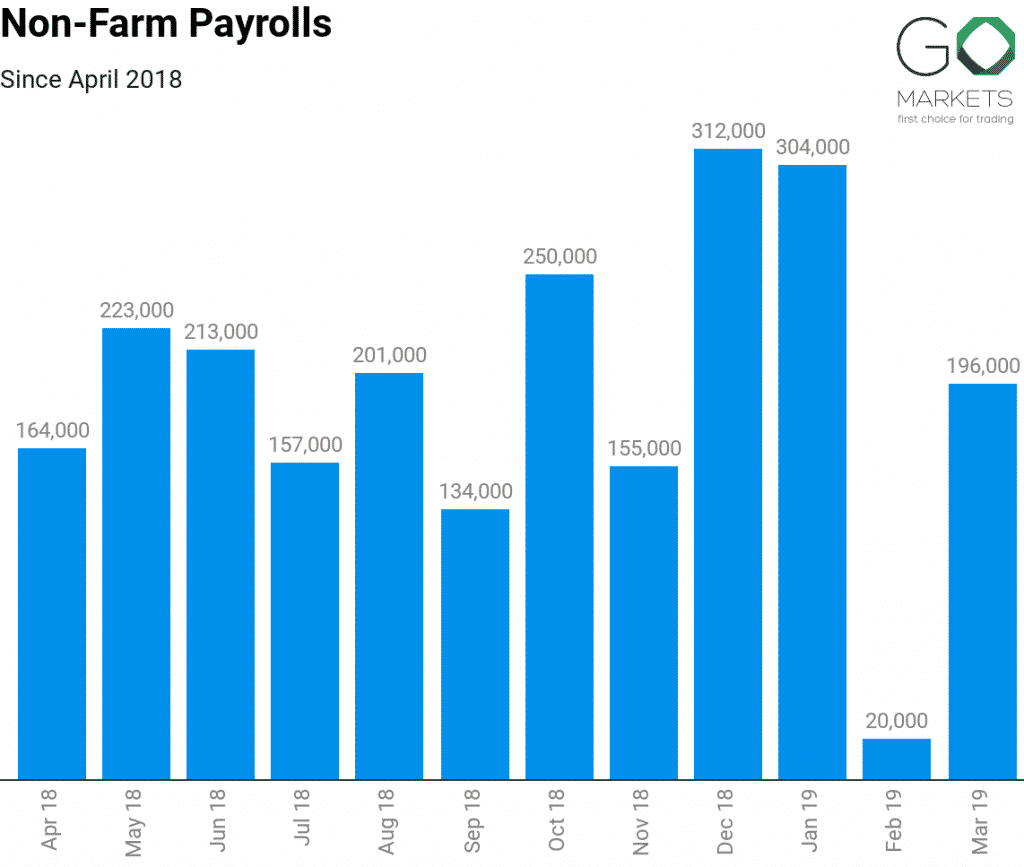

In March, the total non-farm payroll employment increased by 196,000 beating the economist’s forecast of 180,000. Most significant job gains were in health care and in professional and technical services.

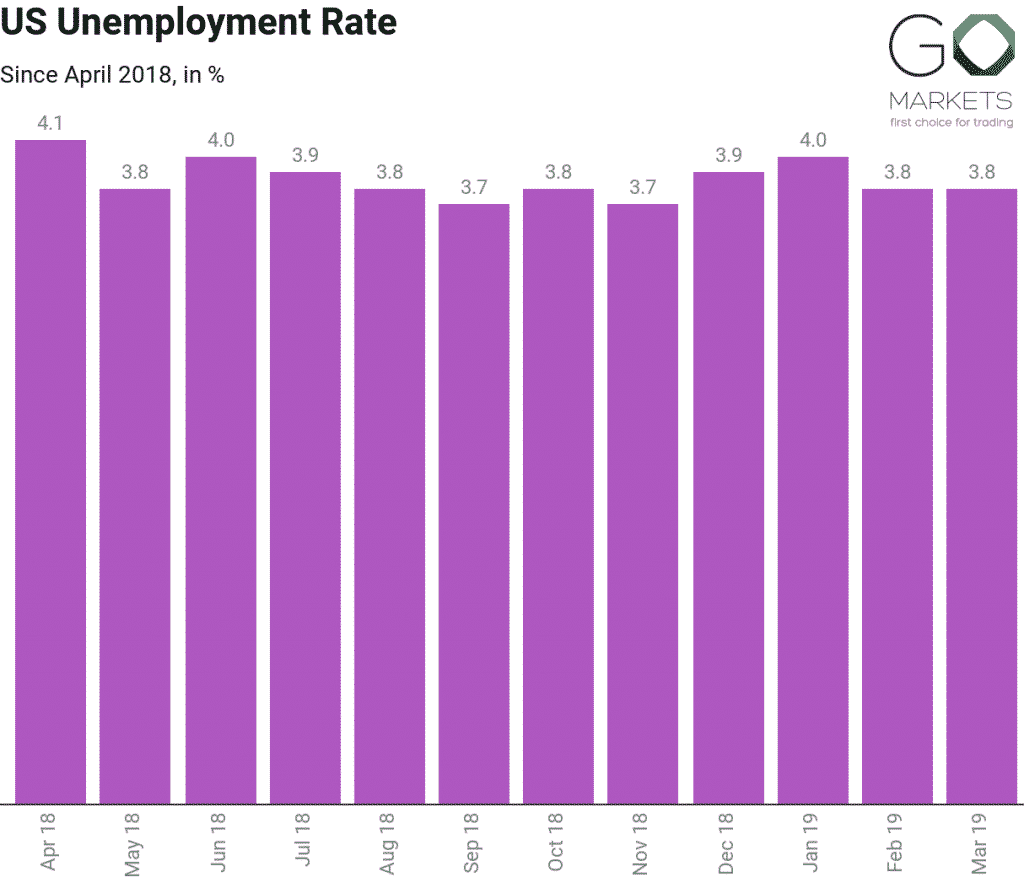

Economists are expecting an increase by 190,000 in the month of April. The unemployment rate is expected to remain unchanged at 3.8%. Average hourly earnings are expected to increase by 0.1% to 3.3%.

All eyes on the announcement.

This article is written by a Encrypt Investment Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Datawrapper, Investing, U.S. Bureau of Labor Statistics

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Largest Crude Oil Reserves in the World

Venezuela At number one, we have a country which has been in turmoil in the last few months – Venezuela. Economic and social crisis have hit the South American nation and things are not looking to get better any time soon. However, it does top the list as the country with the largest crude oil reserves in the world at 300 billion barrels. Wort...

Previous Article

Preview: Bank of England Rate Decision

Brexit has been dominating the news flow in the United Kingdom for a long time, but on Thursday all eyes will be on the latest Bank of England rate ...