Mugabe Steps Down

22 November 2017Mugabe Steps Down

Political tensions have been rising in the southern African nation of Zimbabwe over the last few days as the long-standing leader Robert Mugabe was placed on house arrest by the army in a coup*. The people of Zimbabwe have experienced tough times under Mugabe since he became the leader back in 1980, and on the 21st of November he finally announced his decision to step down as the leader of the country. It’s a historic moment for a country which has suffered deep economic and political problems for many years.

*A coup is the illegal and overt seizure of a state by the military or other elites within the state apparatus.

Timeline of events so far:

- 6th November – Robert Mugabe fires vice-president Emmerson Mnangagwa, clearing the way for his wife, Grace Mugabe to succeed him to lead Zimbabwe

- 15th November – Robert Mugabe is placed under house arrest by the country’s national army

- 16th November – The US calls for a new era in Zimbabwe and asks Mugabe to step down. Zimbabwe’s army chief’s trip to China last week raises questions on coup

- 17th November – Zimbabwe’s ruling party, Zane-PF calls for Mugabe to step down

- 18th November – People of Zimbabwe celebrate the army takeover and urge Mugabe to step down

- 19th November – Robert Mugabe had allegedly agreed to stand down and was expected to make the announcement during a national address, however he defied expectations and remained in charge

- 20th November – Mugabe is accused of swapping speeches before the national address

- 21st November – Mugabe officially steps down as president of Zimbabwe

With Mugabe stepping down, most Zimbabweans will be looking positively into the future, but the future itself will all depend who the next leader will be. It is highly anticipated that the ex-Vice President Emmerson Mnangagwa will take over but that should all be decided in the coming weeks as the transition of power begins.

About Zimbabwe and Robert Mugabe:

Capital: Harare

Official language(s): 16 official languages, with English, Shona, and Ndebele being the most common

Population: 16,150,362 (2016 estimate)

Gross Domestic Product (GDP): 17 billion (total)

Currency: US Dollar

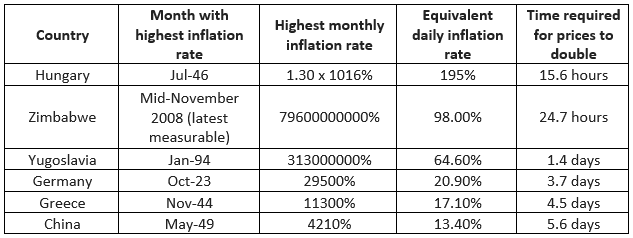

Robert Mugabe has been charge of Zimbabwe for nearly 40 years and at 93 years old, was the world’s oldest president. His time in charge has been full of controversy and corruption which lead Zimbabwe to reach the second highest level of inflation in history at 79,000,000,000% back in late 2008. In 2015, the country announced its decision to demonetise the Zimbabwean Dollar and start using the US dollar. It is worth pointing out that at one point the 100 trillion Zimbabwean Dollars were worth just 40 US cents which puts things in perspective to show how bad the economic situation was. Other currencies used in Zimbabwe include – Euro, South African Rand, Pound Sterling, Indian Rupee, Australian Dollar, Chinese Yuan, Botswana Pula and Japanese Yen.

Highest monthly inflation rates in history:

Source: Cato Institute

By: Klavs Valters

Encrypt Investment

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Oil on the Rise

Oil on the Rise After reaching its lowest price for 15 years back in January, we have seen the oil prices rising in the recent months since June. The price recently reached a two-year high following a partial closure of the Keystone pipeline connecting Canada-US oilfields. With more upcoming meetings and geopolitical tensions rising in the Middle E...

Previous Article

Middle East Tensions

Report by Deepta Bolaky A buoyant open on Oil markets this week amidst clampdown on corruption. The sudden arrests of a dozen princes, business tycoon...