French Elections – The final round

5 May 2017French Elections -The final around

Marine Le Pen, a lawyer, politician and recently the former president of the National Front is facing a young independent centrist untainted by old politics.

Almost a year after forming his party, markets were positively surprised when Macron managed to outcast 2 major political parties that have governed France for more than 30 years. French voters’ appetite for change is understandable following an eventful past couple of years and the candidates with mostly opposing views confirmed it.

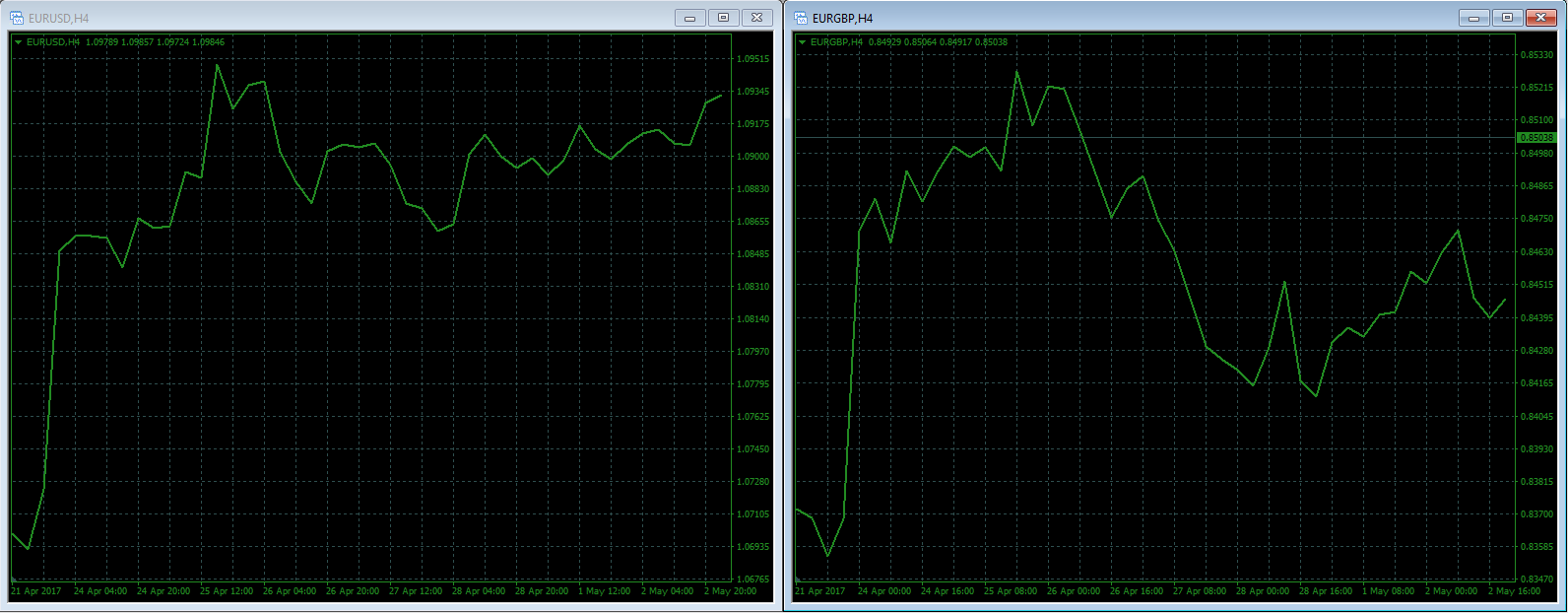

The Euro, French bonds and shares lifted sharply following the first-round results. Markets confidently moved with the news that Emmanuel Macron is making it to the second round.

Click to enlarge

Source: Encrypt Investment MT4

Since then, Francois Fillon who secured 19.6% of the first round votes had endorsed Emmanuel Macron while Jean Luc Melenchon refused to endorse any candidates following his defeat. It will be interesting to see the endorsements for Marine Le Pen leading to the final ballots.

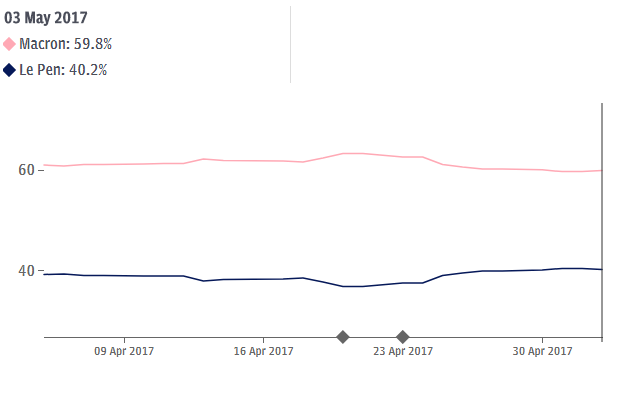

We are now in the final few days of the French Presidential election where two political outsiders will face each other in the final round – 7th of May 2017. Recent polls suggest Macron to be on track to win around 60 % of the vote. It appears that Left voters and those from the Right who voted for Francois Fillon have shifted their votes to Macron.

Click to enlarge

Source: The Telegraph

Can we expect the unexpected again this time around? It will certainly not be a first.

Regardless of the results, we can expect a sharp rise in volatility in the Euro leading to the final day and a big open on Monday. The Euro has been trending up so far indicating a higher chance of a Macron Presidency.

European political risk is weighing heavily on investors at the moment: UK Snap election by Theresa May, the French Election and increased support of Martin Schulz versus Angela Merkel in Germany. The direction of the Euro will be hard to predict over the months but it will certainly be on your Encrypt Investment Watchlist.

-By Deepta Bolaky

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NAFTA – What Happens Next

NAFTA - What Happens Next The North American Trade Agreement (NAFTA) came into effect on 1st January 1994 and it formed one of the World’s largest free trade zones. It laid down the foundations for a strong economic growth for the United States, Canada and Mexico. While there is ample evidence of its shared positive economic impact, but how abo...

Previous Article

United Kingdom – Snap General Elections 2017

United Kingdom - Snap General Elections 2017 2017 is now expected to be an even bigger year for the United Kingdom - On the 18th April, British Prime ...