Electric cars, space travel… and Twitter – Elon Musk becomes the largest shareholder

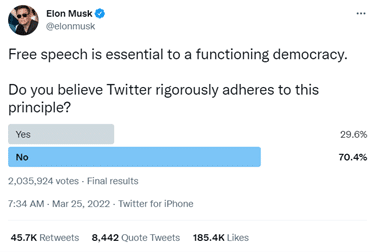

6 April 2022On 25th March, Elon Musk asked his 80.6 million followers on Twitter whether ”free speech is essential to a functioning democracy” and if people ”believe Twitter rigorously adheres to this principle”.

He followed up the tweet with ”The consequences of this poll will be important. Please vote carefully” and he wasn’t joking…

A few days later, the world’s richest person bought a $3 billion stake (9.2%) in the social media company, becoming its largest shareholder.

Top 10 shareholder of Twitter

- Elon Musk 9.2%

- Vanguard Group 8.39%

- BlackRock Fund 4.56%

- SSgA Funds 4.54%

- Aristotle Capital 2.51%

- ARK Investment 2.15%

- Fidelity 2.14%

- ClearBridge 2.09%

- Geode Capital 1.79%

- Nikko Asset 1.56%

Elon Musk has also been appointed to the company’s Board of Directors with the term expiring at the end of Twitter’s 2024 annual meeting of stockholders.

Twitter CEO, Parag Agrawal commented on the latest appointment: ”I’m excited to share that we’re appointing Elon Musk to our board! Through conversations with Elon in recent weeks, it became clear to us that he would bring great value to our Board.”

”He’s both a passionate believer and intense critic of the service which is exactly what we need on Twitter, and in the boardroom, to make us stronger in the long-term. Welcome Elon!”

Musk cannot own more than 14.9% of Twitter during and 90 days after serving on the Board of Directors, according to the SEC filing.

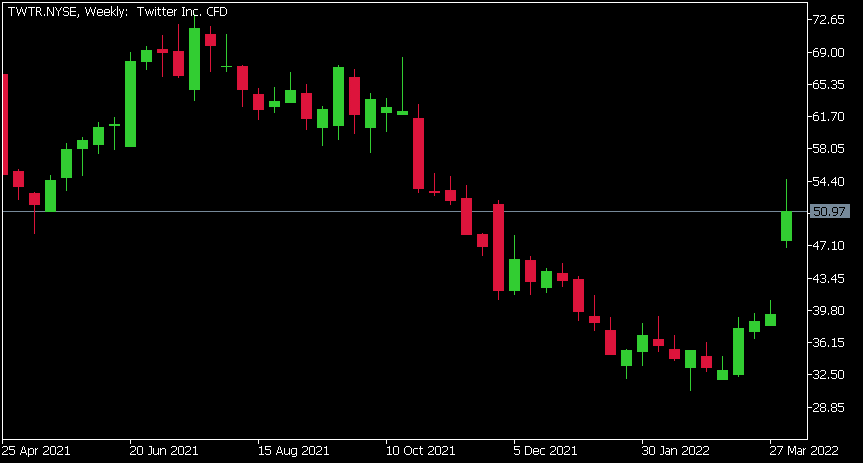

Shares of Twitter have skyrocketed by over 25% since Elon Musk bought a stake in the company. The stock was trading at $50.98 per share – the highest level since November last year.

Twitter Inc. chart

Here is how the stock has performed in the past year:

- 1 Month +56.00%

- 3 Month +24.80%

- Year-to-date +17.95%

- 1 Year -23.91%

Twitter is the 455th largest company in the world according to CompaniesMarketCap with total market cap of $40.81 billion.

You can trade Twitter Inc. (TWTR) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with Encrypt Investment as a Share CFD.

Sources: Twitter, U.S. Securities and Exchange Commission, CompaniesMarketCap, Encrypt Investment MetaTrader 5

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market Update – The week ahead

Equity Indices saw some positive price action over the last week. The US continued to rally, albeit with a sense of unsurety. The S&P 500 finished Friday in a flat session as it saw close to a 4% rise for the week. The NASDAQ and the Dow Jones both followed similar patterns as the market determines its next course of action. From a technical pe...

Previous Article

Tesla Q1 delivery update

Tesla Inc. reported its Q1 2022 delivery numbers on Saturday. World’s largest automaker delivered a total of 310,048 cars in the first quarter of...