Did China Retaliate with a Currency War?

5 August 2019A Currency War

Did China retaliate with a Currency War?

Monday kicked-off with a bang with plenty of big moves in the financial markets. A risk-off sentiment prevails in the markets as dark clouds of trade tariffs resurfaced and are overshadowing the markets. Investors are awaiting for China to retaliate.

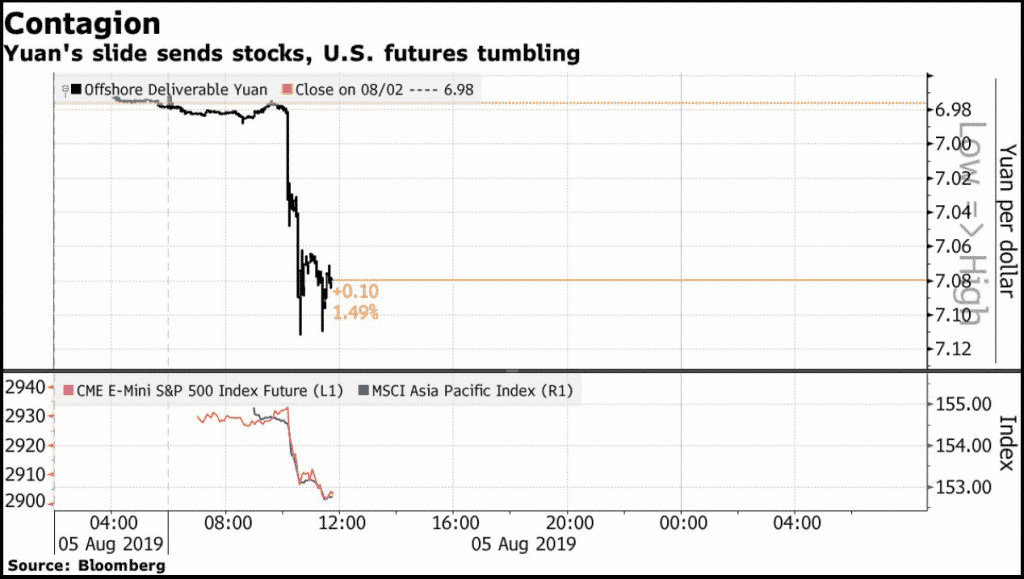

However, the significant fall in the Chinese Yuan might already be “the” signal that Beijing has used its currency for retaliation.

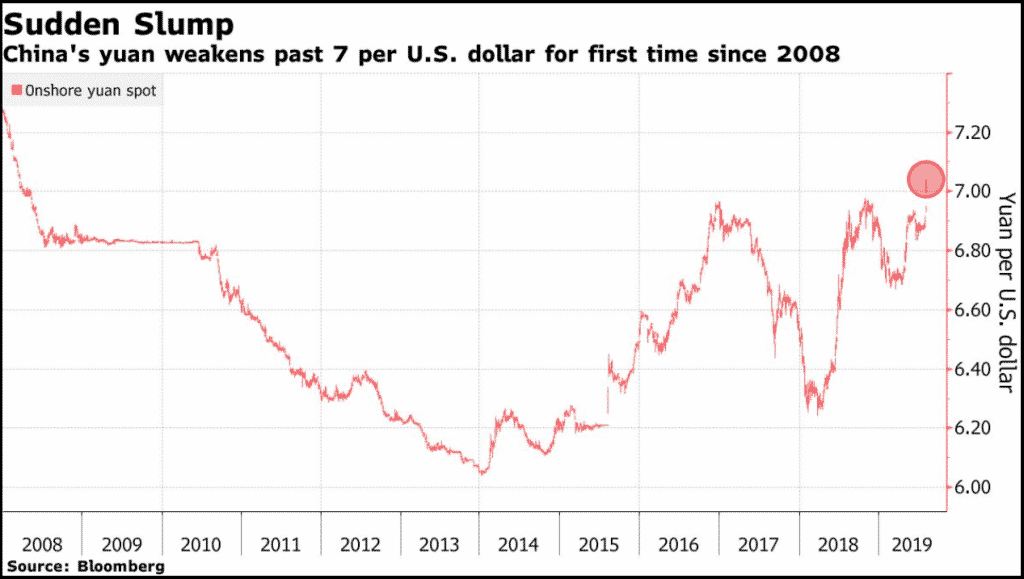

The Chinese Yuan fell below a symbolic level of 7 to the US dollar for the first time in more than a decade after The People’s Bank of China sets Yuan reference rate at 6.9225 – the lowest level in 2019. The central bank blames the tumble in the Yuan on the escalating trade tensions but tried to downplay the 7.00 psychological level.

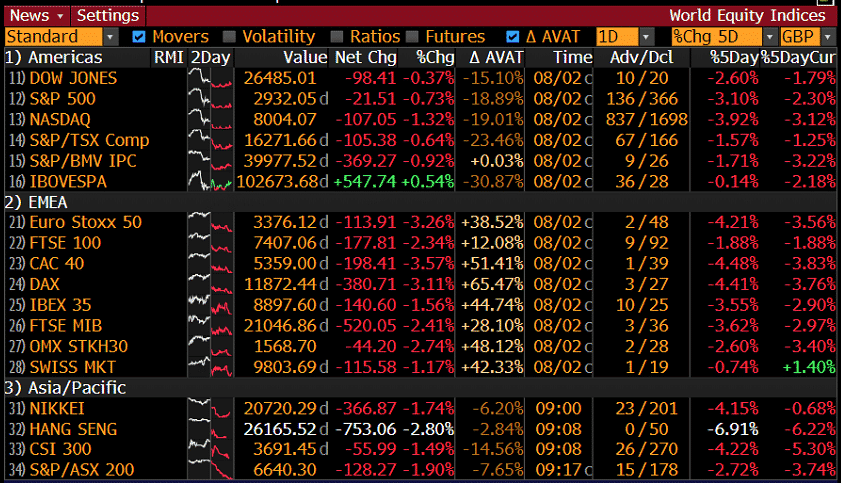

The weaker Yuan created havoc in the markets as investors turned risk-off on fears that a currency war has ramped up. The move has pulled other Asian currencies down to the exception of the Japanese Yen, which is bolstering higher on haven flows.

Source: Bloomberg Terminal

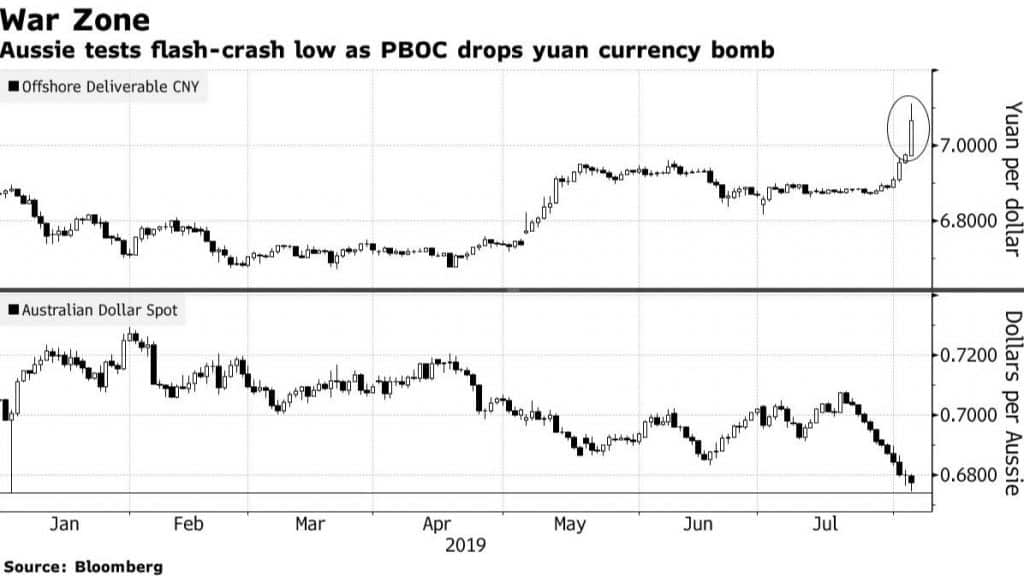

The Aussie dollar was also weaker against the US dollar and dropped to 7-months low at 67.48 US cents during the Asian trading hours.

In the stock market, Asian shares were in a sea of red. The sell-off was exacerbated when Bloomberg reported that China had asked state purchasers to halt imports of American agricultural products.

Source: Bloomberg Terminal

Attention is now on President Trump’s reaction to the Yuan’s slide. European and US futures tumbled, and the markets are poised to a negative open.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

RBA August Statement

The Main Headlines of the RBA August Statement By Philip Lowe, Governor: Monetary Policy Decision The Board decided to leave the cash rate unchanged at 1.00 per cent. The outlook for the global economy remains reasonable. The persistent downside risks to the global economy combined with subdued inflation have led a number of central ban...

Previous Article

When good economic news is bad news?

Market response to any specific economic data release is far from standard even if actual numbers differ greatly from consensus expectations...