Australian Banking Industry

4 February 2019

Australian Banking Industry

The final report of the Royal Commission will be released just after the Australian market closes at around 4 PM!

Hayne’s report will uncover the appalling practices and behaviour in the banking, financial services and superannuation industry. Today will be a crucial and brutal day for Australian Banking Industry and major wealth managers. Last week, the financial sector within the Australian equity benchmark was trading mostly in the negative territory.

The current government believes that bruising the banks will impact the overall economy. The report will pose a significant challenge as they will be faced with the tough choice of protecting consumers and regulating banks and putting pressures on the availability of credit. The tightening in credit can further put pressure on an already-staggering housing market. If the recommendations by Hayne puts a brake on lending at a time where housing prices are falling, it will be a big worry for the Reserve Bank of Australia.

NAB, CBA, ANZ and Westpac

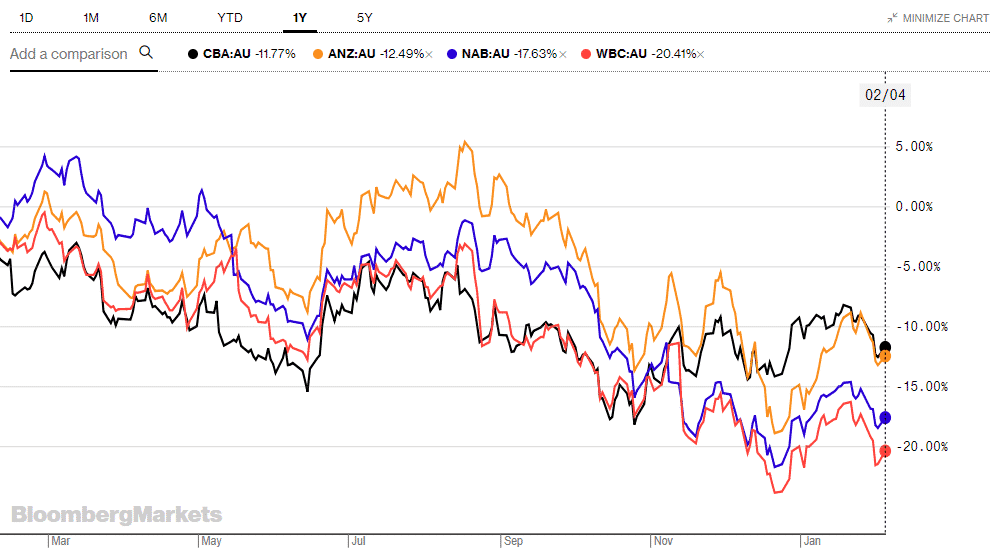

The share prices of the Big Banks have tumbled since last year, and the Final Recommendations will likely fuel the selling pressure.

On Monday morning, the news that ASIC informed CBA to stop charging financial planning fees is also overshadowing the faith of the banking sector.

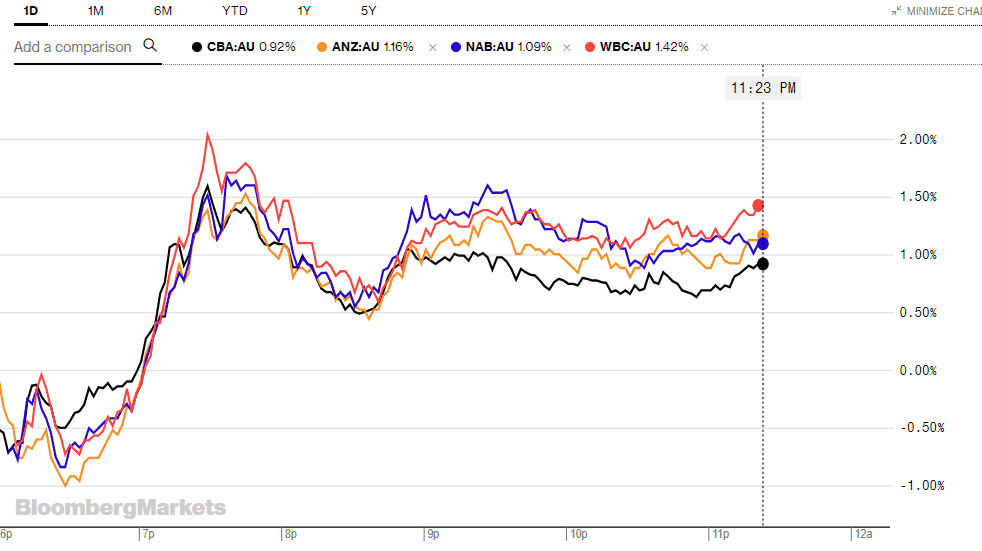

However, as of writing the share price of the big four banks is trending higher unperturbed by the looming release of the final report by the Royal Commission.

Disclaimer: Articles are from Encrypt Investment analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by Encrypt Investment. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Forex 10 Year Challenge

To begin the week, I thought we'd do something a little bit different. We have taken the current ten-year challenge sweeping social media and tried to apply it to a brief technical analysis summary of the major FX pairs. Where were they trading in early 2009? And where are they now? Judging by the list below, it would seem gold wins the gold...

Previous Article

Preview: Non-Farm Payroll Announcement

It’s a new month which means the latest Non-Farm Payroll figures will be released this Friday by the Bureau of Labor Statistics. The data is due t...